Are you a first-time buyer struggling to get on the property ladder?

labours mortgage guarantee scheme can help you!

Feeling like homeownership is slipping away?

You’re not alone.

Labour’s mortgage guarantee scheme might be the game-changer you’ve been waiting for.

Let’s dive into how this scheme could work for you.

How Labour’s Mortgage Guarantee Scheme Works for First-Time Buyers

The scheme’s a lifeline for those of us dreaming of our first home.

Here’s the lowdown:

The plans to make the current mortgage guarantee scheme permanent.

It’s designed to help lenders offer high loan-to-value mortgages.

This means you could snag a mortgage with just a 5% deposit.

No more waiting years to save up that hefty 10% or 20%.

Key Features of Labour’s Mortgage Guarantee Scheme for First-Time Buyers

So, what’s in it for you?

• Lower deposit requirements (as low as 5%)

• Government backing to encourage lenders

• Available for properties up to £600,000

• Aimed at primary residences only

It’s like having a mate co-sign your loan, but that mate is the government.

Eligibility Criteria: Who Can Benefit from Labour’s Mortgage Guarantee Scheme?

Think this might be your ticket to homeownership?

Here’s who it’s for:

• First-time buyers (that’s you!)

• Those struggling to save large deposits

• People with steady incomes who can afford repayments

• Buyers looking at properties up to £600,000

If this sounds like you, you might be in luck.

Labour’s Mortgage Guarantee Scheme vs. Current Conservative Policies

Let’s compare apples to apples.

Labour’s plan:

• Make the scheme permanent

• Focus on first-time buyers

• Part of a broader housing strategy

Conservative approach:

• Current scheme ends June 2025

• No clear long-term commitment

• More focus on existing homeowners

It’s like choosing between a long-term lease and a month-to-month rental.

Labour’s offering more stability for first-time buyers.

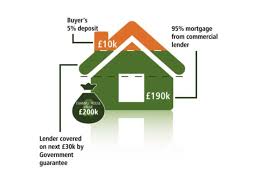

he Impact of Labour’s Mortgage Guarantee Scheme on First-Time Buyers’ Deposits

Here’s where it gets real.

Imagine you’re eyeing a £200,000 flat.

Without the scheme: £20,000 deposit (10%)

With Labour’s scheme: £10,000 deposit (5%)

That’s £10,000 back in your pocket.

Think of what you could do with that extra cash.

New furniture? Home improvements? A well-deserved holiday?

The possibilities are endless.

Labour’s mortgage guarantee scheme works for first-time buyers by making that first step onto the property ladder a lot less daunting.

It’s not just about owning a home; it’s about starting your future on your terms.

Want see how a New build Home Inspection can aid in getting your defects addressed?Book now

Want to try our Home Inspection defect tool Click on the link below or visit www.newhomesinspection.co.uk